French startup, Mistral AI, raised 113M in a first round of financing at a 260M post-money valuation1. In other words, the founders sold ~43% of the company2. The funding has made headlines because of the size of the “seed” round.

There appears to be a misconception that this is relatively expensive capital3: VCs and founders alike have commented on the dilution the Mistral founders took. A common refrain has been that the founders have taken an undue risk or that they would suffer less dilution if they raised a smaller round.

This is incorrect4. While it is true that startups traditionally raise incrementally larger rounds every 12-24 months from Series Seed to IPO and take only 15-20% dilution each round, there is nothing necessarily optimal about that strategy5.

The correct like-for-like comparison is to benchmark Mistral’s cost of capital (equity dilution) against the dilution taken by founders that have raised similar amounts in aggregate (whether spread across multiple rounds or not).

Assuming that the typical, incremental startup fundraise process dilutes founders by 15%-20% each round and that the average startup raises approximately ~100M in aggregate by Series C, most founders own between 41% and 52% of their company6. On that basis, the Mistral founders’ 55% ownership looks quite good.

The immediate objection is that the traditional fundraising startup receives incrementally higher post-money valuations (marks), at each round. So, the Series C, would have been done at a much higher valuation than 245M, presumably making the founders’ paper wealth higher. This is a meaningless illusion. All else equal, two startups with equivalent business metrics and age would be valued at the same multiple, regardless of whether their mark is recent or the startup has been unmarked. The lack of an immediate mark-to-market mechanism in private market does not mean prices remain inefficient when a transaction occurs.

In fact, there are great reasons to raise a large upfront round. From a strictly financial perspective, it de-risks future fundraising again unfavorable macro environments and take advantage of the net present value of money7. For certain types of capital intensive startups, say space manufacturing8, AI training9, or data-as-a-service10, the business may well only be viable with upfront investment. Finally, from an employee perspective, the dilution forecast over a four year vesting period is much clearer if a startup does not anticipate needing future financing11.

I will concede there may be non-financial reasons that dilute the strictly financial advantages of upfront mega-seed rounds. The adage that constraints breed creativity is frequently repeated in the technology world. If correct, the incremental progress and austerity small incremental fundraises bring a startup to success – but this is a purely psychological, not financial, advantage. More likely, a large upfront investment may come with disadvantageous governance terms which, arguably, may be more favorable in a traditional scenario12. Finally, this entire analysis hinges on the assumption that the startup actually needs that capital. Clearly if a particularly capital efficient startup needs a small amount of capital to grow and become profitable, raising more than necessary is effectively giving equity away at a discount13.

113M / 260M = ~43%

As compared to capital raised by “traditional” VC-funded startup that raises in increments.

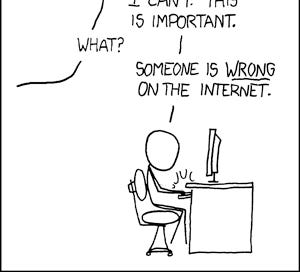

In all seriousness, besides winning Twitter arguments, I am frequently asked about this topic in the context of recruiting for Cybersyn. So, I figured I would create a shareable explanation.

0.85^4 and 0.8^4

All else equal, you prefer money today than the same money tomorrow.

Presumably, the capital at Mistral AI is being used for compute or hardware for LLM training.

I am certainly not unbiased: Data startup Cybersyn raises $63 mln in Snowflake-led funding round

Investors protect again dilution by executing their pro-rata option, but employees usually have no such protection.

I don’t have any information in the Mistral AI case.

But this is true in any fundraise - whether done incrementally or all at once.

Plus they get 5% interest. That’s a pretty nice income stream.